5 Steps to Calculate Your Labor Real Revenue (get it?)

Happy Labor Day! Did you catch my financial holiday joke? <re-read title and insert laugh> Okay… moving on! There are a few business terms that we use every day at Ellevated Outcomes. A few are: retrospective, connective tissue (the team has recently alerted me that I say this all the time – oops), and today’s topic at hand: Real Revenue.

Real Revenue was coined by Michael Michalowicz in his book and methodology Profit First. According to Profit First University, Real Revenue is a term we use to show an entrepreneur that their

Top line revenue, also called total income, is not truly representative of the size of the business. But there is something we can use instead: Real Revenue.

Real revenue = total revenue – subcontractors & materials

Subcontractors and materials are costs directly needed to complete the work. So if you hire a subcontractor to service a project/client or need to buy materials to make the thing you sell, these are your “subs & mats.” This does not include other expenses like W2 employee salaries, software, rent, etc.

For example, if you’re an interior designer, the total revenue on your P&L may show $1M. But after you pay your subs and purchase the furnishings you’ve procured for your clients, your Real Revenue is likely $250K – $400K. This means that at your core, you really have a $250K- $400K business, not a $1M business. When people first hear this, sometimes it stings. But please: still feel good about this accomplishment. I’m going to walk you through how to gather the information and build on it, to perform and feel even better.

But what does this have to do with labor, especially if you’re a service-based business and/or have W2 employees servicing the business?

When we do our signature Profitability Analysis with clients, we want to know: how much Real Revenue is the business actually making on every client, project, or product?

When it comes to a small business that provides services or custom products, the real revenue per hour is our crucial metric. The reason is: when we do the math and give all our labor a common denominator like time, we’re able to compare apples to apples. It’s the key step between collecting data and giving the data a job. We’ve never worked with a client who isn’t surprised by what this information tells us (including us!). In both good ways and bad, it’s a massive aha for everyone.

Here are 5 steps to calculate your labor real revenue:

1. Choose one of your clients, projects, or product lines.

2. Gather the following info for it: total revenue, materials used, and subcontractors employed (for that particular client, project, or product). Subtract the materials and subcontractors from the total revenue. This is your Real Revenue for a specific client, project, or product.

3. Hopefully, you track your time! But if not, don’t worry. Do your best to estimate the time it took to complete this work. Number of hours is ideal, but if that unit of time feels too overwhelming or you think your gut is wrong (it probably is), you can use days, weeks, or months.

4. Divide the Real Revenue by the unit of time (whether you’re using hours, days, weeks, or months). This is your Labor Real Revenue.

5. Repeat with 4 additional clients, projects, or products. Compare the 5 to each other and reflect: what’s surprising to you?

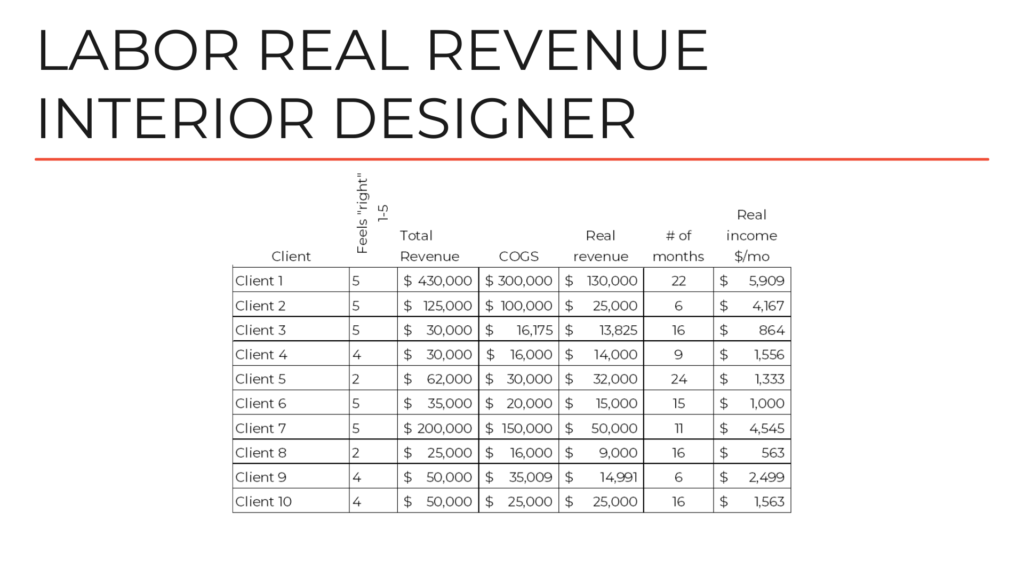

Here’s a completed example:

Your Real Revenue paints a more accurate depiction of the true financial health of your business. It also opens the door to further conversations and business moves: what projects and clients are most profitable? What’s the difference in the ones that are more profitable than the rest? Am I giving away free (or very cheap) labor? Are there other areas of the business that are actually costing me more time and money than I thought, and what do I want to do about those?

And critically: do I have a profit issue, or do I have a cashflow issue?

Understanding this is the first step to eliminate, simplify, and focus. It’s the starting point to turn your $1M total income business into a Real Revenue $1M business.

PS- Thanks to everyone who commented to me about last week’s Barbie post. I had so many thoughtful conversations and while I was nervous, you gave me such a safe place to share. I pride myself on being a real human in business; but it’s extra scary to do so, in writing, on the gulp… internet. So thank you.