Accountant Services for Small Business: Explaining the Duties of an Outsourced Bookkeeper, Controller, and CFO

Over the next couple months, I’ll be going through the ins and outs of small business finance. I’ll do so, weaving together philosophy and strategy with desk-level tactics. Because as we like to say: strategy is nothing without execution. Especially when it comes to dollars and cents, you have to make sense of it (get it?), and your system needs to account for the nitty-gritty details. Otherwise, devastating things can occur (think: embezzlement). So following onto last week’s article about small business tax prep, this week I’m explaining the different types of accountant services for small businesses.

I find that many small business owners are (rightfully) confused about the different parts and players in the finance ecosystem. So I’m going to simply explain the duties of an outsourced bookkeeper vs controller vs CFO. If you’re a small business, depending on your size, lifestage, and your own finance experience, it’s unlikely that you’ll need all three of these players (outsourced bookkeeper, controller, and CFO). In fact, we train most of our clients to be their own controller and CFO. It’s way more cost effective and my personal opinion is: in order to embody the financial pillar of the CEO Mindset, you must know how to act as your own controller and CFO.

As a bit of a preface, I want to recount something I’ve observed over the past few years. When it comes to small business and self-employment, people use the word “accountant” for everything money related. And don’t worry: this isn’t incorrect! According to Forbes:

Accounting is the process of recording, classifying and summarizing financial transactions. It provides a clear picture of the financial health of your organization and its performance, which can serve as a catalyst for resource management and strategic growth.

So yes, “accountant services for small business” does cover it all. But here’s where it’s tricky: When we lump all financial services into one category, it often means that small business owners don’t actually know exactly what they’re looking for.

I’ve been explaining this to people for years, with vocabulary and knowledge from my corporate days, as there’s way more distinction when you work in a large organization. But then a few weeks ago, I decided to look at the question with fresh eyes and true expertise. I asked my friend Siobhan Knox, who’s been an auditor, accountant, and controller in a variety of organizations for the past 20 years. (She’s one of my best friends, and we actually took Dr. Tidi’s Accounting 101 class together, ha!). She explained it this way:

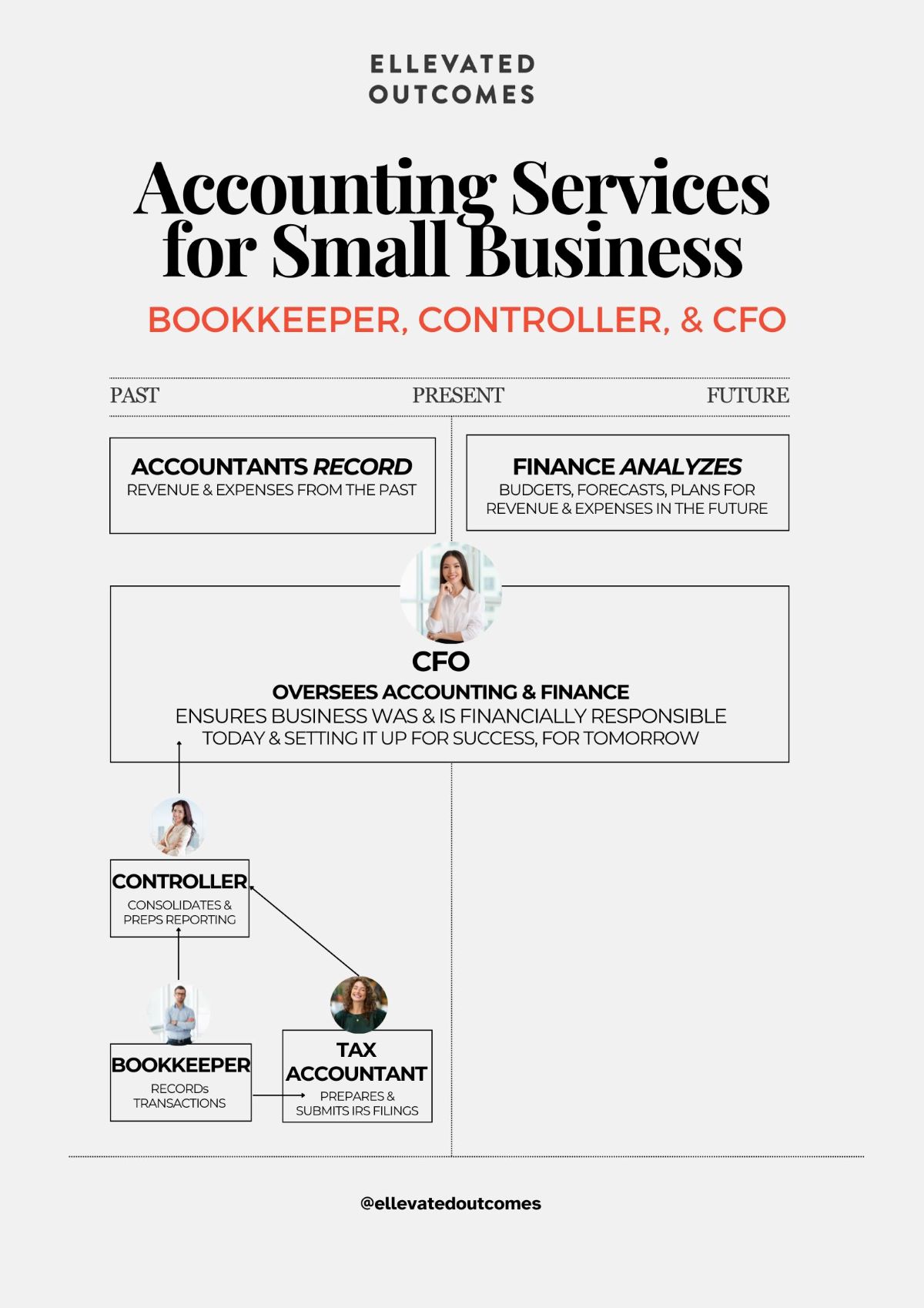

Accountants live in the past, recording expenses and revenue for things that DID happen. Finance lives in the future: budgeting, forecasting, and planning FUTURE revenue and expenses.

The CFO oversees both: Accounting and Finance. But they typically spend more time on Finance, planning for the future.

The CFO’s overall responsibility is to ensure that the business is financially responsible, both today and setting it up for tomorrow.

Super simply: Accounting records, and Finance analyzes.

Then within Accounting, you have bookkeepers (also called operational accountants), tax accountants (not the same as a bookkeeper), and controllers – who consolidate all the preparation and report it to the CFO. Then the CFO will analyze, make business-level suggestions, and plan for the future.

I had never heard anyone describe the past, present, and future timeline; and I love it! Here’s a diagram:

So if you think about it, do you see why I think that small business owners should learn to be their own CFO? (At least for a decent period of time; there’s definitely a tipping point where an outsorced CFO can make sense).

A CFO’s responsibility is to ensure the business is financially responsible, both today and setting it up for tomorrow. And a Small Business CEO cannot and should not outsource that. No one will care about your business’s financial health like you. And no one will know your business as well as you, to know the levers you can pull to become more healthy.

Ellevated Outcomes does not pretend to be CFOs (we’re not that good at Excel – except maybe for Erin Wolff, ha). But depending on a client’s stage, we often focus on Finance as one of our strategy pillars. To us, a fully financially sound business includes:

- Automating owner’s pay

- Tracking P&L and cashflow

- Budgeting and forecasting

- Creating and maintaining cash reserves and estimated tax allocations

- Structuring profit sharing

So we help our clients create the structures for these because we don’t think this should be outsourced. We want you to understand and actively design the financial structure you’re putting in place. After all, that’s how they’ll be unique and special to you.