Our Company Playbook for Economic Uncertainty

I was in Boston with Julia two weeks ago, when news of the tariffs hit. So it wasn’t a surprise that many of our meetings kicked off with questions about the impact of current and future economic uncertainty. When people asked for my viewpoint, I responded: it’s (more than) reasonable to have fears, BUT I believe that every downturn holds opportunity. So when difficult periods like this arise, at Ellevated Outcomes, we return to our company playbook for economic uncertainty.

On the heels of all this talk of uncertainty, I was listening to an interview with therapist Lori Gottlieb. She said something that struck me as so meaningful and applicable to entrepreneurs, on this very topic:

With freedom comes responsibility and uncertainty.

So when I hear someone talk about economic uncertainty, I internally retort: “Another day in the life…!” After all, as a creative small business owner, it can feel like you’re living in economic uncertainty even in the best of times. But certainly, during moments when the world is panicking, that uncertainty can feel magnified x10.

Whether you’re a solopreneur or team of 25 (or more), during periods of unrest, we recommend you center yourself on 3 As:

- Attuned to your strategy,

- Agile in execution, and

- Anchored in service.

None of these are dramatic moves, nor sexy, quick fixes. They’re the continuation of a sustainable foundation. Because a sustainable foundation = resilience.

Nothing below requires a huge pivot; to the contrary, these steps counsel against that. Keep the strategy sound, yet (perhaps) tweak the execution. And fear not: if your foundation isn’t solid quite yet, for each step, I suggest a small Just Do It Action you can take today: a micro-step that will consume a tiny amount of effort but will have compounding effects for your future.

Step 1: Continue your Savings Systems

It might feel counterintuitive, but now is exactly the time to double-down on your long-term financial resilience. Economic slowdowns tend to make people pull back, often at the expense of future security. If you have retirement or business savings systems in place, don’t hit pause on your contributions. Keep the system running.

If you don’t have savings systems in place, start right now (I know it may sound crazy, but really: there will not be a better time).

- Open a SEP IRA or Solo 401(k). If this is brand new to you, I like entrepreneurs to start with 5% of their take-home pay.

- Set up monthly auto-transfers to a business savings account for taxes (15% of real revenue).

- Set up monthly auto-transfers to your rainy day fund (personally, I like 2 months’ operating expenses).

The goal is to program this into your systems so that it becomes an invisible, unnoticeable habit.

Just Do It Action

Transfer 1% of last month’s revenue to a savings account.

Step 2: Be Visible (Don’t Hide)

Surely you’ve heard the age-old response mechanisms of fight or flight. (The newer version includes fawn or freeze, but this is above my paygrade). When it comes to economic uncertainty, I beg of you: don’t flee. This doesn’t mean that you need to aggressively fight, but I repeat: flight is not the answer.

I totally understand: fear makes people want to disappear. I promise you: I’m no different.

Visibility builds trust. And in uncertain times, trust is currency.

Go to the events. Send the newsletter. Call the client. When in doubt, be even more present in your community. People do business with those they know, like, and remember. Be the business (person) they remember.

Just Do It Action

Make one meaningful, 1-1 contact. Send one of your vendors a thank you note. Call a referral source to ask: “How are you?” Send your top client flowers. Get creative and enjoy the connection. Use this visibility opportunity to get offline and IRL with someone. You’ll be the one who showed up. You’ll be memorable.

Chapter 3: Double Down on Client Experience

According to Will Guidara, author of Unreasonable Hospitality, the US is no longer a manufacturing economy; we’re a service economy. In fact, >75% of US GDP is driven by service. Even globally, >65% of GDP comes from the service economy.

When times are tough, people still spend. And the good news for businesses with great service is: people spend more consciously. That means it’s not enough to sell a good product (or service); buying something from you needs to make your client or customer really feel something.

Ask yourself:

- How can I add surprise or delight to our interactions?

- What do my clients need right now, emotionally or practically?

- What’s one small thing I could do that would feel like 10x value to them?

To me, this is by far the biggest opportunity for small businesses during economic uncertainty. THIS IS OUR TIME TO SHINE, PEOPLE!

Just Do It Action

No matter what business you’re in, call a client or customer out of the blue and ask: “How are you today, what’s something on your mind I could help you with?”

Step 4: Tweak, but Don’t Freeze

Further to step 2, we recommend that you don’t freeze. You can absolutely take a quick pause, in order to thoughtfully respond, but don’t make an across-the-board decision to freeze on everything. When people do this, it’s because they’re waiting to see what others will do, instead of following their own strategy. You’ll hear others talk about placing a freeze on hiring, launching a new product, marketing, or investing. If you have a sound strategy that keeps things tight and light for your small business, you shouldn’t need to freeze. Because you’re simply taking the next incremental step to move your business forward.

You shouldn’t pivot your entire strategy. If anything, you’re tweaking the execution of the strategy, but not the strategy itself.

Momentum matters. Keep moving.

Just Do It Action

If you’re feeling tempted to pause on something, answer: how could I tweak this to make it feel safer, without eliminating it?

Step 5: You May Have to Work Harder Right Now for the Same Results, and That’s Okay

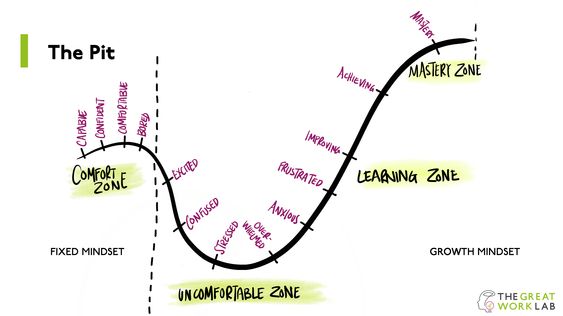

Sometimes, you have to work twice as hard for the same result. It doesn’t mean you’re doing anything wrong; it means you’re living through a time when things take longer, convert slower, or feel heavier. It won’t last forever. And to the contrary, when the tough period lifts, the momentum you’ve built in your flywheel, means you’ll profit handsomely and with ease, in the future.

You can prepare yourself mentally for this, without being defeatist. This is choosing resilience over resistance.

You’ve done hard things before. This won’t be the first tough period, and it won’t be the last one. You can do this, too.

Just Do It Action

For any external threat that you’re feeling right now, pinpoint 1 micro-opportunity. Remember: threats and opportunities are corollaries. The opposite of every threat is a market opportunity.

Stay on Your Course

If your business isn’t being affected right now, that’s okay. In fact, it’s downright wonderful. Be kind, be generous, and stay aware of how others may be feeling. But don’t get pulled into hype or panic if it’s not your reality.

Every business moves through its own seasons. Stay in your lane. Keep showing up. Use these 5 steps as your simple, step-by-step company playbook when the ground beneath you feels a little wobbly. Stay attuned to your strategy, agile in execution, and anchored in service.

Afterall, for creative small businesses, uncertainty isn’t the enemy. It’s the cornerstone of our opportunity.