What exactly is… a Market Opportunity?

A handful of our clients are in the midst of writing their first business plan. A few are new owners, but several of them have owned their businesses for five to ten years, and their idea and work have taken off so well that they’ve never needed to formally write one. But now that they’re in big expansion mode, they need a written plan to make their real estate and investment dreams come to life.

So far, we’ve covered the pieces that feel natural enough: mission, vision, values, and core competencies. After all, most business owners know who they are and what they’re doing.

Therefore, the Market Opportunity is where things start to feel nebulous. One thinks, “If what I’m doing now is working fairly well, why do I have to know what’s going on beyond my purview?”

But sussing out the market opportunity is so useful. It helps a business owner zoom out of his/her everyday happenings and see opportunities and risks that (s)he wouldn’t anticipate by just humming along la quotidienne.

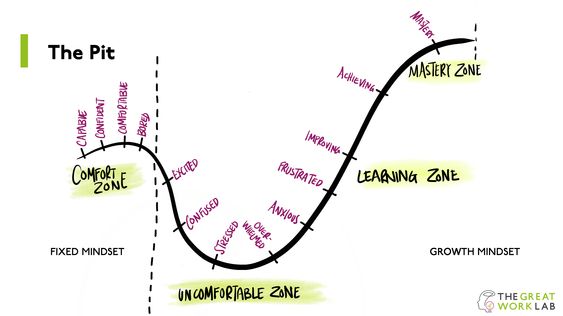

After all, chances are if you’re doing a business plan, it’s because you want something better… something different. And how can you get that, if you don’t step away and think about things differently?

So I’d love to break down for you the key parts of a market opportunity (or market analysis) that I find most revealing and useful.

1. the (textbook) Opportunity

First, take a pause to consider: what industry and market am I operating in? I divide these two things and size them up.

Consider the industry as the thing that you’re doing. What skill, product, service, or passion are you selling? If you’re a financial adviser, that’s the industry that you’re in. Now: what are the trends, opportunities, and threats in this industry? How big is it?

Remember, this is what distinguishes “opportunity” from “company strengths.” We’re not looking for the opportunities immediately touching your business or what your particular business does well. We’re zooming out and examining this at an industry level.

Then, to whom are you selling your products and services? This is your market. And it’s one of the many places where being as detailed as possible is an asset. You want to know your customers inside and out. Step away from your day-to-day work, and research what trends are affecting your target market. How big is your market (remember, different from industry)? Then, once you know how many people your market is, you can multiply out revenues and come up with a total market opportunity.

2. the (real) Opportunity

By now, you know that I’m someone who says, “Pick up the phone and talk to a real human!” For even though many people view the business plan and market research as an academic exercise, it has the potential to be so much more than that. If done well, it can help you see your business with fresh eyes – spotting opportunities for expansion that will differentiate you and move your business forward.

So although I’m a proponent of research – especially to help you get your baseline numbers – I’m just as big a fan of gut-checking your textbook facts with dialogue and qualitative, real-life feedback.

Check yourself with surveys, interviews, and a second opinion on your findings. Test the assumptions that you hold and the way you do things. I was taught to qualify these types of chats by calling them “fact finding” conversations. Most people are (more than) delighted to share their opinion and view on things. One of the reasons that many businesses fail is because what holds up perfectly in theory doesn’t hold up in real life. This will help.

3. PESTEL

This is one of my favorite (nerdy) tools to zoom out and consider opportunities at large.

PESTEL stands for political, economic, social, legal, environment, and technology. Think of these as guideposts to walk you around the question “What is happening in the world, which could affect my business?”

Here are some examples that illustrate the type of large-scale issues that have the potential to affect our businesses, whether they’re large or small. (Each of these represents a real-life implication to EO’s clients).

- Political // Does Brexit affect your business?

- Economic // Is buying your product or service dependent on disposable income (and therefore a healthy economy)?

- Social // Does the Me Too movement create opportunities or threats for you?

- Technology // While digitization and automation create “scaling” opportunities, does the lack of 1-1 contact in the world present client intimacy opportunities?

- Environment // Are there ways that your business could cater to those of us who want to play our part in preserving the environment?

- Legal // Do you work in a highly regulated industry, like real estate? What assumptions do you make about the laws in place today, which may or may not be true, three to five years from now?

4. Porter’s 5 Forces

This is another classic textbook example, which many people know. Porter’s 5 Forces essentially answers the question: how competitive is my industry, and how much power is outside my control?

There are four external forces to examine: potential entrants, buyers, substitutes, and suppliers.

The question is: how much power do they have over your success? I like using a traffic light system to determine if each is green, yellow, or red, then use a rough average to determine if the internal rivalry (which is the fifth force) is green, yellow, or red.

For example, Ellevated Outcomes is in the super-red industry of business coaching / consulting / advising! Although we’re not dependent on suppliers, we’re completely dependent on

- clients buying our service (red);

- prospects electing a substitute, which in our experience has been: do nothing (red); and

- potential competitor entrants, as there’s no barrier to entry (so we’ll call this crimson red, haha).

So overall, the industry internal rivalry is pretty red. Yet, you’ll notice that we’re obviously still pursuing it. The point here is not to base go/no-go decisions on one of these analyses but rather to identify the big-picture opportunities and threats, then plan accordingly.

5. Complete your SWOT

Remember how we started the SWOT a few weeks ago, but I mentioned that we could only complete the strengths and weaknesses at that time?

Now we have the information to cap it off with opportunities and threats. By completing the four prior steps, you’ve done all the work to corral the information; now, all you have to do is summarize and fill in the two last quadrants!

Next Steps:

Complete steps 1-5, above.

This should take time, both in your research and asking for others’ feedback. By the end you should be able to answer three questions:

- What’s the size of my industry? Of my market?

- What are my most pressing opportunities and threats?

- Is there a need (known or unknown) that my business could fill?

The real work here is not in the writing-down-what-you-already-know. If you have a business or an idea for a business, I’d assume that you know the industry fairly well already.

The stimulating part is to challenge your assumptions about what you think you know. It’s hard but so worth it. This is the work where the magic can start unfolding: where we turn glimpses of opportunities into hey-I’m-actually-onto-somethings.

We see and secure opportunities that may have been lying dormant, just waiting for the right entrepreneur to come along…